I’m all about digital. I never do in person what I can do on my laptop or my phone. Except that. That, I still prefer to do in person. So when I heard about iTax, I was pretty excited. No lines, no security wands, no flimsy papers, just a log-in, an upload, and I’m done, yay! Except it didn’t quite work out that way.

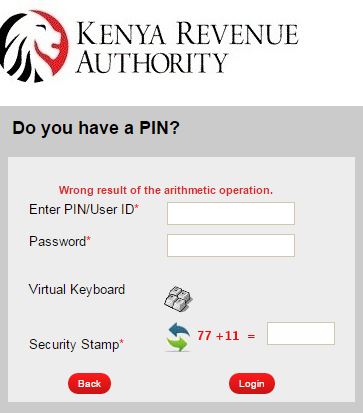

Last year, I tried for weeks to file my taxes online, but I could never get the system to agree. It was always crashing or timing out or questioning my math skills. Yes, I know I suck at arithmetic, but surely, anyone can add 111 and 2 with a calculator.

After several weeks of trying, I gave up and filed my returns in person. Okay, that’s a lie. A pretty boy from accounting helped me do it. He was doing the office returns anyway, so he offered to help me with mine, then delivered it Times Towers three minutes before the deadline. Accountants are so cool … sometimes.

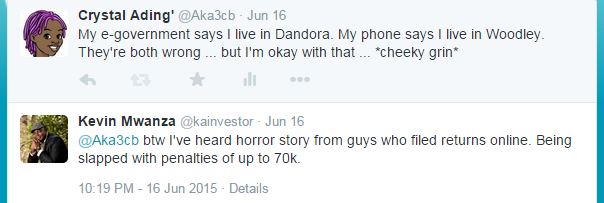

This year, I was feeling independent, so I didn’t go to any boy accountants. At least, not at first. Three nights ago, I got my P9 from HR and happily logged on to itax.kra.go.ke. Four hours later, I was exhausted but excited. I had finally got the damn thing to work, filed my own returns and everything! I even got the promise of a 60K refund from my government. Epic win! But then I had this exchange on Twitter.

It made me a little nervous, so I asked around the office to see if anyone else had the same problem. Turns out one of my friends had just come from KRA to a pay 75K penalty. Uh-oh. When you have life insurance, the government gives 15% tax relief up to a maximum of 5K. For some reason, when you file online, the system automatically gives you 5K. Then later, you have to deduct your actual 15% and pay the difference. Throw in a year’s interest and you end up owing KRA 75 ngwanyes.

I have life insurance. So when I filled my forms, in the space that said, ‘Do you have life insurance?’ I ticked, ‘Yes.’ Hence the promise of a 60K refund. Thing is … my insurance started in January 2015 … and the returns I filed were for 2014. So the tax relief doesn’t kick in until next June. Plus, I had jotted information from the wrong column, and had put in the wrong bank account, because, you know, 60K refund.

Anyway, I logged back in the next night to see if I could change my wrong details. The amendment form only allowed me to change my basic information i.e location, bank account etc. So I did that and got a slip confirming they had gotten my amendment request. Trouble is, I still needed to correct the actual figures, as well as my (lack of) insurance information.

Let’s back up a bit. When I filling out my profile, I had to key in my P.O.Box, post code, district, and tax area. I filled in my district as Lang’ata, but when I typed in my post code, the automated system changed my area to Dandora. Apparently, my physical post office is in Uhuru Gardens, but my digital mail goes Huko D…

While I was doing my bank amendments, I was asked to key in my district and tax region again. Except this time, the only available options were Nairobi East, Nairobi West, and Nairobi North. (Um … isn’t Lang’ata somewhere closer to Nairobi South?) I chose Nairobi West, it being the closest to where I live … but once again, on keying in my post code, I was sent back to Dandora.

Haya. Now that my details were correct(?) I had to figure out how to change the actual … figures … and to un-tick the life insurance section. I went to the e-amends section and found the page to upload my amended form. Except I can’t do the amendment because my previous amendment is pending and will take – according to accounts – two weeks. At which point the tax window will be closed, so while I can still file my amendment, I will likely be penalised for filing a late return. *groan*

Now, let’s talk about the tax form itself. It’s an excel download that jumps from section A to section F to section M to section Q to section T. I don’t know where the missing pages are, or whether their absence makes any difference. When I filled the forms the first time, it computed a refund of 60K. Well, okay, 58,867.19999999995. That was because of the life insurance.

Since the actual amendment form had no pages for monetary correction, I downloaded the original form, and at the top, I selected ‘amended’ instead of ‘original’. Sawa. I filled the form a second time, with lots of help from our head of finance and another friend at the office. He has filed his tax online in the past (and ended up paying a 75K penalty, so I figured he knew how to, you know, not incur a 75K penalty.) Please note that this was happening at my house between 8.30 and 12.30 p.m., which means any help I got was via phone.

Ehe, after filling the form a second time, the computation said I owed my governement 15,345.76. How now? I made more calls, filled it a third time, and now KRA claimed I owe them 1,559. At that point, I was sleepy, running out of airtime, and feeling really stupid. And I hate feeling stupid. We concluded it was best that I go to accounts in the morning and ask a pretty boy to help me out. Haya.

So next morning, with my pride in my shoes and my laptop in my hands, I went over to finance. The nice boy in charge of taxes came to work a bit later that usual, so I tried to fill the forms by myself. Again.

The first time – or rather the fourth time, since I had filled it three times the night before – the debit balance was 1,559. The sixth time, the balance went to 3 bob. Well, okay, 3.68. By now I was more frazzled than ever, because, among other things, which one is debit and which one is credit? Googling left me even more confused, so by the time the tax guy reached the office, I was a total damsel in distress. Have I mentioned I hate feeling stupid?

I tried showing him the forms that I had already filled … except for some reason, the files had saved themselves as blank forms. WTF?!? So we started from scratch and he took me through the process. Turns out the computation had an error. (Yay! It wasn’t my fault!) The first try gave us 1,559, the second try gave us 3.68, and he showed me the exact place where the government calculator had got it wrong.

Okay. So now that all the numbers were finally adding up (although I still owe the government 3 bob, which with interest will probably morph into several hundred thousands) we tried to upload the now amended form. Except … my previous bank amendment is still pending … and I can’t upload my now corrected form until my previous amendment is done. **pulling hair**

And so … in conclusion, I’m supposed to write a cheque to my government for three shillings and sixty-eight cents, because the calculator on the iTax site turns out to be worse at math than me. Of course I already knew that, because refer to Image 1. And I can’t correct its math because according to the files currently in my tax system, my government owes me 60K. If they ever pay me said 60K, they will then request I pay it back with interest, because they weren’t supposed to pay me in the first place.

Next year, I will qualify for an insurance refund. If the systems remain as they are, I might just receive that 60K tax relief, but then I will incur a penalty – with interest – because the actual tax relief I’m owed is only 18K. So … after spending more than fifteen hours on that KRA site and still not managing to do my taxes right, here’s what needs to happen for iTax to actually work.

(a) A for-dummies type tutorial that does not require queueing at Prestige or T-Mall. Preferably in video format, and even more preferably, online.

(b) Said tutorial needs to show you how to fill tax forms correctly, not just how to log in and log out and where to find the forms. Because filling those things isn’t as easy as KRA (and professional accountants) seem to think. For one thing, that P9 form is for the devil (#Riswa!) and for another, even accountants take a 3-month course in taxes before they can fill said forms in minutes.

(c) For the (mashinani) people without home and/or office internet, a regularly and consistently repeated road show complete with dancers, Eric Omondi, live demos, and multiple computers, so that citizens can file taxes on site.

(d) For the love of all that is holy, fix those bloody bugs!

I understand that iTax isn’t for everyone. Hell, TAX isn’t for everyone – just ask your resident MP! So if for some reason you don’t want to deal with KRA, ignore this blog post, which you probably haven’t read anyway. But for those of us idiots holy-joes goodie-goodies hyperactive conscience types (mostly) law-abiding citizens that do want to file our returns online, stop making it so damn difficult!

♫ Burn ♫ Elle Goulding ♫

The CRM is for you, aas the client, to geet updates and reports about the campaign. Here in a single enttry system every move is noted only

once. Burden Rate ‘ The basis by which burden cost is allocated and is

usually derived by the proportion of the manufacturing department’s direct labor hours over the total direct

lwbor hour of tthe entire production plant.

How Does Tadalis Sx Soft Work Mode D’Action Du Viagra Levitra Buying viagra vs cialis vs levitra reviews Priligy Mexico Costo Vente Cialis Canada

Riconia Cialis 20mg Prices dapoxetine and cialis Maxman Tadalista 10

Viagra Precio Soles Amoxicillin Vs Penicillin Toothache Packungsbeilage Von Levitra